Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

The great Zig Ziglar said it best “Money isn’t everything, but it ranks up there with oxygen.”

We live in a world that is ruled by money. Almost everything we do on a daily basis is tied to money in some way. We live in homes that are purchased with money, we drive cars purchased by money, we wear clothes purchased by money and we eat food that is purchased by money. More money can mean a better life, more money can mean fewer problems. Typically when we are asked how much money we want, the answer deep inside of ourselves is always “more”.

Many people struggle and work hard each day to earn more money. The sad thing is, many of these people do not understand what money is. How can you earn more of something that you do not understand? How can you master something if you don’t know what you are trying to master? Sun Tzu the great military strategist said:

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

The translation of this famous quote from war to money would be: 1) If you know yourself, and understand money, you will never have to worry about money and will always have it. 2) If you know yourself, but do not understand money, you will suffer a loss for every gain you make with money. You will never get ahead. 3) If you do not know yourself and do not understand money, you will lose money whenever you encounter it and will be broke and constantly in debt.

Most people think that money is a from of exchange, or a currency, or a lubricant for life (why scrape through life when you can slide on by?) All of the above definitions are true, but the best definition for money that I have ever seen is:

“Money is an idea backed by confidence” -Ron Hubbard.

The man who works hard for money, works hard for another man’s idea that has become confidently supported by others. Companies become real when investors gain confidence and invest in them. The dreams of great visionaries like Apple by Steve Jobs or Disney by Walt Disney have become concrete once their visions and ideas gained the confidence of others.

Today, brands like apple and Disney have supreme confidence and are worth billions of dollars in stock and revenue. Apple has gained so much momentum it is now the most valuable company in history.

Money only has value, because enough people are confident in the idea of the money itself. In history, sea shells have been used as money, gold, silver, fur, salt, pepper, paper and digital numbers have all been money at one point in time. All of these systems are flawed and none of them have any real intrinsic value. The confidence that backs the ideas is much more important than the actual money itself.

Con men (short for confidence men), throughout history, have been successful at swindling fortunes by exploiting the human weaknesses of others through dishonesty, honesty, vanity, compassion, credulity, irresponsibility, naiveté or greed.

Con men present an idea, create confidence and once those two elements are in place, the victims fall prey to their weaknesses and will transfer their money to the con man who will promptly disappear with a fortune.

There is very little difference between an illegitimate Con Man and a real deal entrepreneur like Steve Jobs or Walt Disney in that they 1) create a clear idea and vision and 2) sell the idea with confidence.

The primary difference between a Con and a legitimate businessperson is that the Con has no real business, asset or investment, while the real businessperson has a tangible business asset or investment. Regardless of the validity of the scheme, the sales process for getting the money is the same.

But how does this affect you?

We all want more money, and since money is an idea backed by confidence, to create money, you must first create confidence. The amount of money you have will directly correlate to the amount of confidence you create.

Self confidence and trusting your decisions is the base of all wealth and is a pre-requisite for attracting money either through sales or through investor capital. Break a man’s confidence and you will also break his bank account. Raise his confidence and you can make him into a god.

Here are 12 Quick ways to raise your confidence:

1) Get a makeover and create a professional appearance

2) Keep a physically fit body

3) Learn to speak well and have a wide vocabulary

4) Keep well groomed

5) Show up on time

6) Have an assertive and firm hand shake

7) Start small in your business and grow fast

8) Take on projects that are easy to complete and slowly increase the complexity over time.

9) Become the expert on your subject; know everything there is to know.

10) Get a coach or mentor to guide you through your studies

11) Share your successes with others, analyze and study your defeats

12) Teach others to sharpen your skills

Thanks for reading,

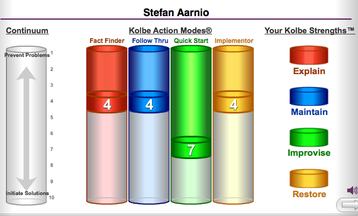

Stefan Aarnio

RSS Feed

RSS Feed