Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Remember: Please share this article if you found it helpful

It’s the unconquerable soul of man, not the nature of the weapon he uses, that insures victory.” – General George Patton.

Why are some people absolutely unstoppable while others quit at the first sign of difficulty?

Why do some people manage to make it to the gym every morning while others only show up on January 1st and quit by January 7th?

Why do some marriages fall apart after 5, 10, 15 or the 20 year mark while some last "until death"?

Why do immigrants who come to a new country with nothing manage to get rich while others born with every advantage slip into poverty?

The people who manage to push through adversity all have one thing in common: They have a strong "Why".

A wise man once said "Some men have 1000's of reasons to fail, but they only need 1 reason to succeed".

Simon Sinek, a brilliant speaker, educator and researcher discovered the concept of "The golden circle".

Simon wanted to know what the difference was between the average person and the exceptional person.

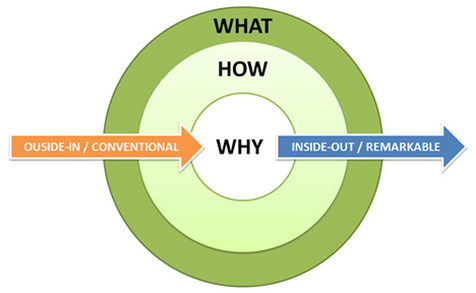

What Simon discovered was that behind every person, organization or business there is a WHY, a HOW and a WHAT.

The average person, business or organization focuses on the WHAT first, the HOW second and may never address the WHY. These people work from the "outside-in" and focus externally.

The exceptional person, business or organization focuses on the WHY first, the HOW second and the WHAT last. These people work from the "inside-out" and focus internally first.

The results between the average and the exceptional are both shocking and yield completely different results.

Consider two computer companies: Apple and Dell.

On one hand, communication from Dell operates from the outside-in:

1) WHAT We make great computers,

2) HOW they are beautifully designed and easy to use, "want to buy one"?

3) WHY - ????

Communication from Apple on the other hand is from the "inside-out":

1) WHY - With everything we do, we believe in challenging the status quo,

2) HOW - the way we challenge the status quo is that our computers are beautifully designed and easy to use,

3) WHAT - we make great computers, want to buy one?

To compare the results of Apple to Dell in the last 5 years: Apple has become the most respected brand in the world many years in a row and the most valuable company in history, while Dell has fallen off the radar.

The golden circle can easily be applied to fitness as well.

The average person approaches the gym on January 1st every year with the following mentality:

1) WHAT – I want to get fit this year and lose some weight

2) HOW – I am going to buy a gym pass

3) WHY – This is my new year’s resolution

This person is usually delinquent on gym attendance by the time February rolls around because a new year’s resolution is not a strong enough reason to ensure success.

The exceptional person approaches the gym with the following mentality:

1) WHY – I must go the gym consistently to create and maintain the body I desire. This is integral to my self-image, self-esteem and personal success.

2) HOW – I will go the gym every day

3) WHAT – I will have a fit and healthy body that reflects my self-image, self esteem and personal success.

If I were a betting man, I would bet on the “exceptional” person every time for success because the “why” is much stronger and I know that the mission will be accomplished.

When you compare the emotional strength of a “new years resolutions” vs. “my personal self esteem”, self-esteem will win every time because it is a much stronger emotion than an arbitrary goal set at a new year’s party.

When the golden circle is applied to marriage, it is very easy to see which married couples will “make it” and which ones won’t.

Divorce rates are at an all time high right now because many people set up their marriages with the following mission:

1) WHY – We’re getting older, balder and fatter; we both want to raise some kids before it’s too late.

2) HOW – We will get married because marriage is required to have kids.

3) WHAT – Kids, aren’t they wonderful?

This relationship will last at a maximum 16-20 years because these people got married on the premise of raising kids. As soon as the kids are old enough to leave home, the marriage usually falls because the marriage was not built on the premise of a primary relationship; these two people are not committing to each other - they are committing to the kids.

A stronger marriage that would last “until death” would be:

1) WHY – We are in this relationship to help the other person become the best he or she can be. My partner spiritually compliments me and I spiritually compliment him or her.

2) HOW – We will spiritually commit to each other, make it official and get married

3) WHAT – A spiritual union between two committed people through marriage - Children may happen.

The reason to succeed needs to be greater than the reason to fail; if the WHY is strong enough, then success is ensured.

Unfortunately, finding the “why” in our businesses, personal lives and relationships is not an easy task.

What can be even more cumbersome is the fact that many of us may be in our businesses or personal endeavors for the wrong reasons.

If you are in a business or relationship for the wrong reason, correct the mistake, establish a new “why” and watch your success reach new heights.

Remember: a man can have thousands of reasons to fail, but he only needs one reason to succeed.

Thanks for reading,

Stefan Aarnio

Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

P.S: Please share this article if you found it helpful

RSS Feed

RSS Feed