Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

Better than a thousand days of study is one day with a great teacher. – Japanese Proverb

When most people get started on the path to "self made wealth", many of us choose one of the following:

1) To become a real estate investor

2) Start a business with an MLM company aka Multi Level Marketing

Both of these paths are very difficult and there is no easy way to success. For myself, I chose to become a full time real estate investor and dedicated all of my resources towards success in my field. In some ways, I envy the people who start with MLM companies because MLMs are:

1) Cheap to start

2) Come with training

3) Have an "Upline" of information (aka coaches and mentors are part of the system)

4) Build a residual income by establishing a team or downline

5) Offer great and cheap personal development programs

When I look back on the resources, time, money, opportunity cost and risk that I spent to get into professional real estate investing, I am astounded at the "startup cost" of the business. In many ways, an MLM would have been safer, cheaper, and faster than becoming a pure real estate investor. Here is why,

Real Estate Investing is:

1) Expensive to start (down payments are expensive and training is expensive)

2) Mistakes are expensive

3) Risk and leverage can crush you

4) No set path for success

5) Coaches and mentors are hard to find

However, as I advance further into Real Estate Investing, I begin to see more similarities between Real Estate and MLM's than differences.

The first similarity is what I would call an information "up-line".

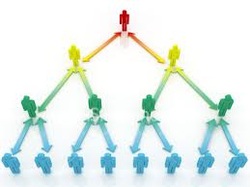

THE UPLINE

One of the biggest mistakes that I made when starting out in business (first music, then debt buying, then real estate) was that until fairly recently, I had absolutely no informational up line. I define an informational up-line as a coach, mentor or teacher who has more experience in the business, a higher degree of success and has accomplished what I was trying to do. Completely ignorantly, I fumbled around in the dark for far too long making costly mistakes. Appropriate coaches and mentors could have prevented 90% of my mistakes, but I was too cheap to hire one.

"The only way to know the right steps to take is to study with those already taking the right steps. Douglas Vermeeren"

MLM's are smart businesses because many of them come with an up-line of information. The up-line shows you the ropes and teaches you how to achieve success in the business. In real estate investing, I have paid some obscene fees to coaches and mentors to correct my past mistakes and take my business to the next level. What is even crazier than the fees I pay are the results. Although the fees are high, the results are always worth it. If you are in real estate investing, and don't have an "up-line" to help you on your path, I would suggest that you get one immediately. Of course, your "up-line" will have to be paid somehow, so consider paying a fee or give them equity in a deal you are doing. One of the reasons why I love real estate is that it is a blank canvas, whatever you wish to create, you can create. The possibilities are endless.

A mentor is someone who allows you to see the hope inside of yourself – Oprah Winfrey

THE DOWNLINE

In multi level marketing, there is an up-line of experienced mentors to help you in the business, and of course, you have a downline underneath you to push you to higher levels of success. In real estate investing, you must build a downline as well. The downline, in my opinion, is everyone on your team who helps you build a passive income. These people are:

1) Your contracting teams

2) Your wholesalers

3) Your bird dogs

4) Your realtors

5) Your property managers

6) Other investors who invest in you and refer business to you

I have made it my mission to adopt the Coca-Cola philosophy and "pay everyone who touches the product". Anyone who refers business to me, whether it be realtors, bird dogs or other investors, will always get paid in cash or equity because these people make me income, and mostly passive income. It's my job to be the up-line and train everyone on the team to work together, work efficiently and work the way I want them to work. I must educate them so that they can be the best team members possible and help me achieve success.

THE SUMMARY

The more I study the business of real estate investing, the more I see that real estate is the same as an MLM company. If you are not yet started in real estate, I would recommend joining an MLM for the training to learn how to run a business. More investors fail to become professional investors because of a lack of soft skills in general business. Many investors know how to do deals (real estate is very primitive), but have no idea how to run a business. The skills you can learn by joining an MLM are priceless. I chose to bi-pass this education and paid a much higher price for my skills. Looking back, having an MLM business on the side would have saved me a lot of time, money and effort. If you are in real estate today, make sure you have an up-line and build a profitable down-line - It's imperative to your success.

Thanks for reading,

Stefan Aarnio

Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

P.S: Please share this article if you found it enjoyable!

RSS Feed

RSS Feed