Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

In North America, for the past 100 years, we’ve had an astounding progression of wealth. Every generation from 1900 has enjoyed a better life with more opportunity and more amenities than the last. Our grandparents (the war generation) who lived on the farm gave their children a better life by moving to the city. The children (the baby boomers) grew up and got manufacturing jobs, then the next generation grew up, went to university and got middle management or intellectual careers (Generation X) and today we are at the next step in the progression: Generation Y.

Unfortunately, where other generations had an “easier” time claiming a better life than their parents, I can see that Generation Y will be the first generation to be poorer than their parents.

The poorest person today in North America has far more amenities than a wealthy man 200 years ago ie: flushing toilets, heated water, refrigerators etc. Even in the poorest households in Canada, first world amenities are available. We live in a very wealthy time, but unfortunately, like musical chairs – the music cannot go on forever and eventually someone is left without a chair. In the game of inter-generational musical chairs, generation Y will be the generation “without a chair”.

I know first hand how difficult it is for Generation Y to fit into the ever-changing economy. I’m born in 1986, graduated from high school in 2004, university in 2008 and hit the job market later in the same year. I did everything conventionally ie: go to school, get good grades, get a degree, get a good job and instead of landing a promising career, I wound up with post grad depression and lay on the couch for months while trying to find something that matched my talents, skills and useless degree.

The sad part is, in 2004 after high school, I took a summer job painting houses for $10 per hour and I worked that summer job every year until I graduated university in 2008. In 2004, minimum wage was $6.50 per hour, so $10 per hour was a great deal. By the time I finished school in 2008, minimum wage had inflated to almost $10 per hour. My first job out of school was a dead end, telephone sales, straight commission, middle of the night job that earned $10 per hour even after hitting my sales targets and ranking in the top 5 sales people. I felt like I had sold out and was sold a fraud. I was better off skipping school and opening up a house painting business. I remember seeing that skilled painters could make around $30 per hour and I was now making $10.

Today in 2013, in Winnipeg, Manitoba where I live, minimum wage is now $10.45 and it will be increasing again next year – along with the price of every single commodity in the economy.

But forget my first hand experience, why is it that Generation Y will be poorer and have a more difficult life than their parents, the baby boomers?

Here are 15 reasons why:

1) Faster changing job market

a. Generation Y will statistically change jobs every 4 years. It is no longer feasible to get into a career or company and stay for life – the world is changing too rapidly and labor is always in flux. There is a high probability for Generation Y to learn and relearn skills many times throughout their lives and they will not be able to stay in one place very long.

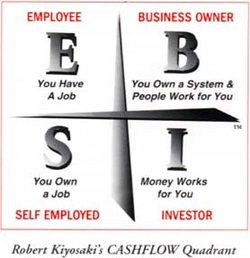

2) Highly skilled knowledge workers are needed and formal education does not offer young people what is required.

a. We live in a primarily knowledge based economy today where the skills to survive are not readily available. For myself, I am an entrepreneur and the knowledge and skills required are unavailable from traditional education institutions like universities and colleges. Apprenticeships and internships are coming back so that young people can actually learn practical skills needed for a successful career. For the last 10,000 years, humanity has acquired skills through apprenticeships. Universities, as trade schools are a relatively new idea, and an idea that fails to deliver what it promises.

3) Too many options

a. Having no options can be a luxury, in today’s world, too many options is certainly a burden. Making a choice to commit to a career is more difficult nowadays because young people are bombarded with hundreds of options. In reality, we only need one path to become successful, but the illusion of too many options creates doubt and inaction.

4) No mentors/parents

a. Where the baby boomers enjoyed a nuclear family ie: Mom, Dad and a collection of brothers and sisters. Most of the Echo boomers or Gen-Y families are divorced. Many young people don’t have access to the guidance or mentorship that other generations had access too. In the old days, if your father was a blacksmith, you were a blacksmith and he mentored you. Today, you barely know your father, hardly see him and when you do see him, he has nothing valuable to say.

5) Increasing inflation ie food/clothing/shelter

a. The economy is inflating at a rapid pace. Items like food, clothing and shelter get increasingly expensive every year while wages stay the same. A rising minimum wage doesn’t help because when the bottom rises, so does everything else in relation to the bottom. Buying a house was once a necessity for the baby boomers and for the echo boomers it may become a luxury or impossibility.

6) Increasing education costs and education fraud/deception

a. Education is increasingly expensive year after year in both Canada and the United States. In Canada, we have a much easier time financing education, but sadly, many students leave school with a mortgage of student debt (minus the house). In contrast, our parents could finance education with a few months of work at a summer job at the end of the school year.

7) Fewer workers are required

a. Businesses require fewer and fewer workers to do the same tasks. Between my laptop and cell phone, I do not need to hire a secretary because the technology can handle the work of many people. Other technologies wipe out entire classes of workers like 1) ATM’s replacing bank tellers and 2) automated factories have mostly replaced human assembly lines ie: the decline of Detroit in the last 60 years.

8) Manufacturing has moved overseas – global competition, not local

a. Generation Y not only has to compete with the local boys and girls for jobs, they also have to compete with their peers in India, China and around the world. I can hire a graphic designer for $300 in Toronto, or get a similar product for $30 from Pakistan. Sadly, $30 goes a long way in Pakistan and the designer in Toronto can’t even make the rent on $300.

9) Increasing household debt

a. Not only does Generation Y have more debt through student loans, the entire household that they come from has more debt than ever. Low interest rates has made debt affordable and not only is Generation Y loaded with credit card debt, The boomers (their parents) have remortgaged their home with a Home Equity Line of credit, have multiple auto loans, and maxed out credit cards.

10) Parents who cannot retire and will become a burden

a. We are sold a fantasy of retirement in North America that at age 55 (or 65) you will get to golf and lie on a beach all day. The reality is that the vast majority of baby boomers will never retire and shortly after the “kids” move out (generation Y), the “parents” (baby boomers) will be moving back in with the kids (to their small home or apartment that is unaffordable). However, this isn’t too terrible, around the world in Europe, Japan, China, India, and even North America 100 years ago, it was normal for inter generational families to live together. Unfortunately, the dream of the retirement that the “war” generation had is smashed forever for the sweeping majority.

11) The deception that 30 is the new 20, lost time

a. Somehow, generation Y is one of the most “babied” generations in history. Adulthood is now pushed towards 30 because of overbearing parents and over sheltered kids. It also takes more resources and more time to do things that were once normal like 1) Moving out of Mom and Dad’s basement and 2) Starting a career that can provide a living. Losing an extra decade to school or “finding yourself” will severely affect your long-term wealth and ability to invest for your future. An extra 10 years for your money to grow can in theory allow you to have twice as much principle in the future.

12) Less work ethic

a. Along with an over sheltered generation Y is a poor work ethic. Generation Y is more interested in Facebook and Twitter than they are with putting in the time and getting ahead. Bill gates used to say “Your grandparents had a word for flipping burgers, they called it opportunity”. It amazes me to see how little interest there is in “getting your hands dirty” or “starting from the bottom”. Gen Y wants to be handed the corner office on a silver platter.

13) More materialistic

a. Because Mom and Dad were “keeping up with the Jonses”, their children, Generation Y, are much more materialistic than their parents were. Their parents had to slave away and save for years to afford the house in the suburbs and two brand new cars (purchased on credit). Without ever working to earn, young people want to keep up with the illusion of success and have financed their glamorous lifestyles on 1) student loans 2) credit cards or 3) hand outs from mom and dad. Sadly, all of the resources above will eventually run out and when they do, the over spending youngers will be hit harder than a heroin addict going cold turkey.

14) The attitude that “we should have it better” than our parents, when in fact, we will have it worse.

a. Many young people do not even try to enter the job market or start at the bottom and work their way up. They remain underemployed working at Starbucks while trying to become an actress, artist, musician, writer or some other esoteric dream without facing reality. The truth is, generation Y will have a much more difficult time growing up and raising a family than the boomers did and we will have to work much harder than our parents ever did to achieve the same lifestyle.

15) Technology changes the game every 5 years or less

a. The last threat to Generation Y is that technology is changing every 5 years (or less). New jobs are being created and old jobs are being deleted just as fast. We can never predict which technologies are coming next and which industries will be forever changed or wiped out. Think of Blockbuster getting annihilated by Netflix or the traditional record labels becoming wiped out by Napster and online music. There are always young and hungry entrepreneurs looking to wipe out the dinosaur businesses of the past.

I don’t want to appear to be overly pessimistic in light of all of the facts above. There is more opportunity in the world than ever; new jobs, new markets, new technologies and new businesses can be created in record speed and magnitude. However, it will take a smarter, harder working, and more creative generation to capture such opportunities and that is what Generation Y must focus on becoming.

Thanks for reading,

Stefan Aarnio

Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

RSS Feed

RSS Feed