Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

One of the most common questions that we all hear on a daily basis is: "What do you do?"

For some, this is an easy question; "I'm a doctor" some may reply; or "I'm a teacher" everyone understands that doctors treat sick people and teachers teach. For others, the questions "what do you do?" is much more abstract and hard to answer.

In the past, I had introduced myself as an "entrepreneur". Some people say that "entrepreneur" is a nice word for "unemployed" or "unemployable". The problem with being an entrepreneur is that is that entrepreneurship is so vast and abstract that most people cannot understand what an entrepreneur does.

When you say "I'm an entrepreneur", the common reaction is a blank stare, and then the following question "so, what do you ACTUALLY do?"

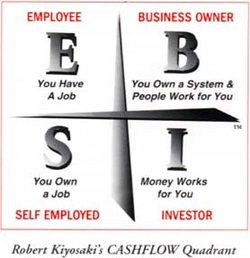

In truth, entrepreneurs are responsible for the entire business, or multiple businesses. They hire, fire, delegate, select projects, start projects, finish projects, manage and even sometimes work in the business. However, the entrepreneur has 1 job that only he or she can perform.

A great businessman once said; "there are only two jobs that you cannot ever pay a person to do"; These are the job of the entrepreneur - everything else can be done by someone else.

The two jobs that cannot be done by anyone other than the entrepreneur are:

1) Think

2) Do things in the right order

In Michael Gerber's bestselling book "The E-Myth", Gerber explains that there are three roles that the entrepreneur must play when he or she starts a business:

1) They must be the Entrepreneur, the visionary who paints the broad strokes and has the energy and drive to start the business.

2) They must be the Manager, the person who oversees the operation and ensures that it functions efficiently and sustainably.

3) They must be the Technician and handle the daily transactional work in the business.

All tasks in an organization can be delegated or hired out to either a manager or employee and many organizations can run very efficiently on mostly Technicians and Managers. However, the Entrepreneur is responsible for all of the strategic thinking in the business and he or she must determine the right order of operations and proceedures.

No matter how good your technicians are or how good your managers and employees are, they can never replace you as an entrepreneur. They rely on you to think and create plans for them to execute.

So many businesses fail because the entrepreneur is negligent to think and appropriately delegate: A ship without a rudder always smashes up on the rocks.

I have broken the above rules many times in the past and have learned my lessons first hand. Today, I make sure that I am the only person in charge of the sacred tasks of the entrepreneur. To break this rule is to expose your venture to disaster.

Thanks for reading,

Stefan Aarnio

Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

RSS Feed

RSS Feed