Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

I was having a conversation with a friend of mine and I asked her for her opinion on the local Asper school of business.

Her answer surprised me "needed for some, not for others."

Formal education usually has mixed reviews in the business world. Some people love it and swear by it, others think that it is an outdated dinosaur of the industrial age.

Although I did attend the University of Manitoba, and did take classes at the Asper school of business, I am a business school drop-out. My ambitions for taking classes at the school were quickly quenched when I learned that they were grooming me to become an employee and not an entrepreneur. No matter how much education is received from an institution like Asper, the teachers are employees and they train people to think like employees.

Many of the world's greatest entrepreneurs were drop outs: Steve Jobs of Apple, Bill Gates of Microsoft, Mark Zuckerburg of Facebook, Henry Ford and others. These men build their businesses on passion, experience, and practical hands-on-study in their fields.

"Formal education will make you a living, Self education will make you a fortune." - Jim Rohn

With enough hands on study and experience, these great entrepreneurs build the most valuable asset of all - sound business acumen. The greatest difference between most WANTrepreneurs who have day jobs and real entrepreneurs who derive their livelihood directly from their businesses is:

1) Entrepreneurs live off of their business acumen

2) WANTreprenerus trade time for money

Where entrepreneurs can turn their ideas and passions into assets that create strong enough income to reach their dreams, many WANTrepreneurs are stuck trading time for money building someone else's dream.

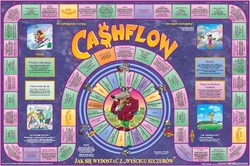

In Robert Kiyosaki's game CashFlow, there are two circuits:

1) The Rat Race, a wheel that the players circulate around in collecting pay checks. In the Rat Race, these players have jobs and trade time for money. It doesn't matter if the player has a low paying job like a Janitor or a high paying job like a Doctor. All of the players in the Rat Race trade time for money, have a limited earning potential, are susceptible to the pitfalls of relying on a fixed income i.e.: players may become downsized and lose 100% of their income for a short period.

2) The second circuit in Cash Flow is called the Fast Track and on the Fast Track players move much faster. The Fast Track is reserved for players who have strong enough business acumen to create enough passive income to exceed his expenses. In other words, these players have become smart enough to not need their jobs and live off of their ability to invest and create income. Players on the fast track make disproportionately more money, have larger deals, cannot be downsized, and are unaffected by many other disadvantages of the rat race.

One circuit relies on trading time for money, the other relies on business acumen.

Many new investors and WANTrepreneurs want to make the transition from the Rat Race onto the Fast Track, but the sad thing is, many of these WANTrepreneurs refuse to invest in their financial education - the most important asset of all.

Your education and business acumen is the greatest asset, far more valuable than Gold, silver, cash, stocks, real estate, companies. All of these "real" assets mean nothing if there is not a strong base of skill and education backing these symbols of wealth.

But if formal business school teaches most people to be employees, then where can one get an entrepreneur's education.

There are many places to get an entrepreneur's education:

1) Books written by real entrepreneurs

2) Seminars for teaching business put on by real entrepreneurs

3) One on one coaching from real entrepreneurs

4) Mentorship or apprenticing under a real entrepreneur

The key word with all of the above is REAL entrepreneurs. When choosing to learn about entrepreneurship or business from someone, it is counterproductive to learn from a good employee. Employees are trained to think differently from entrepreneurs and they collect pay checks instead of build companies.

ACTION STEP:

In your life, ask yourself; "are you living off of your business acumen?" Or are you trading time for money?

What do you need to get to where you want to go?

Who do you need to help you get there?

Thanks for reading,

By: Stefan Aarnio

Freedomway.ca

facebook.com/stefanaarnio

https://twitter.com/stefanaarnio

http://ca.linkedin.com/in/stefanaarnio

Get Stefan Aarnio's book "Money People Deal: The Fastest Way to Real Estate Wealth" at MoneyPeopleDeal.com!

Remember: Please share this article if you found it enjoyable!

RSS Feed

RSS Feed